5 Ways to Fake It ‘Til You Make It

/We all desire to be wealthy. We watch the VH1 specials on the “Fabulous life of (insert name of celebrity here)”and some of us go out and try to emulate these lifestyles despite the fact that our incomes differ from those of the famous and wealthy. (Just a minor detail though, right?) We yearn to vacation where the stars vacation, own the clothes they wear, or eat at the newest restaurants they dine at. It’s safe to say we have fascination with wealth, possibly because true wealth eludes many of us. We often recite the phrase “fake it ‘til you make it” as a justification for our spending habits. Most people “fake it” in the wrong manner. Instead of adopting the good practices of wealthy individuals, we tend to mimic the consumption practices of the wealthy and incur debt in the process of trying to “look the part”. The practices we should be mimicking are the sound financial practices that help these individuals build and maintain wealth.

If you follow these guidelines like you’re wealthy, “fake it”, you will be on the way to “makin’ it”! Here are the “5 Ways to Fake it Til You Make It”:

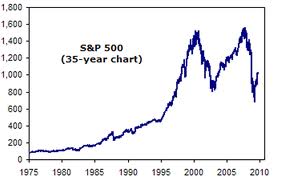

1. Buy Assets – Investing in assets - purchasing things that will increase in value over time - are a great first step in building wealth. (Sorry, the iPad 3 and designer jeans don’t make the list) Investing in stock, bonds, and real estate are just a few simple assets that serve as great foundations of wealth generation.

2. Start a Business – What do Bill Gates, Warren Buffet, and Mark Zuckerberg all have in common? They all started businesses and built mass amounts of wealth working for themselves. (Zuckerberg is only 27, it’s never too early to start!) Entrepreneurship is a great avenue to build wealth while doing something you love and have a passion for. There is some risk involved with being an entrepreneur, but if you look at the Forbes list of the wealthiest people, you will see the risks can surely pay off.

3. Spend Wisely/Save – No one has accumulated wealth or maintained their wealth by spending every last dime they have. A key to wealth generation is spending wisely and that involves creating a budget, spending conservatively, and saving consistently. Before you go out shopping, do research to ensure you are getting the best value for your money. Don't be afraid to negotiate for lower prices (when applicable). If you haven't done so already based on my previous posts, take a step in the right direction and open a savings account today!

4. Keep Debt to a Minimum – Debt is not always a bad thing and is often needed to assist with things such as education expenses and real estate purchases. But the goal should be to keep your overall debt burden to a minimum and to avoid “bad debt” such as credit card debt. You cannot attain wealth if the value of your liabilities (what you owe) surpasses that of your assets (what you own). That is known as “negative net worth” and is the opposite of wealth.

5. Understand the Tax Code – Doing your taxes can seem like a daunting task, however there is great value in understanding the tax code and knowing all your potential deductions or better said, ways to make sure your money stays your money. To be clear, I am not advocating tax evasion, there are perfectly legal ways to lower your tax liability on an annual basis. If you don’t have the time to learn the relevant tax code then seek the help of a qualified accountant or tax lawyer who can assist you with your annual tax filing and help you plan for the year ahead. If we have discovered one thing from the recent Occupy Wall Street uprising, wealthy individuals often pay a lower effective tax rate in comparison to lower income citizens. Tax planning is key to protecting wealth.

*Bonus – Network, network, network! Remember, ‘your network determines your net worth’. So get out there and meet like minded individuals. It can help you get on the road to wealth you so desire.

Riches can come and go but wealth lasts for generations. I can’t wait to see the VH1 special about your fabulous life!

About the Author: Femi Faoye is the Co-Founder and Chief Executive Officer of D.R.E.A.M. He’s a staunch and passionate financial literacy education advocate.

Disclaimer:

Notwithstanding any language to the contrary, the views expressed in this post reflect those of the author and are solely theirs and do not reflect the views of Developing Responsible Economically Advanced Model-Citizens, Incorporated or any affiliates. Opinions are based upon information the author deems reliable but Developing Responsible Economically Advanced Model-Citizens, Incorporated does not warrant its completeness or accuracy and should not be relied upon as such. Neither the author nor Developing Responsible Economically Advanced Model-Citizens, Incorporated guarantees any specific outcome or profit from recommendations presented and you should be aware that losses may occur following any strategy or investment discussed. This material does not take into account your particular investment objectives, financial situation or needs. Before acting on information in this post you should consider whether it is suitable for your particular circumstances and strongly consider seeking advice from your own financial or investment adviser.

The contents of this post cannot be redistributed without the explicit written consent of the author and Developing Responsible Economically Advanced Model-Citizens, Inc. All images in this post owned by Developing Responsible Economically Advanced Model-Citizens, Inc. may not be used in any advertising, publicity, or otherwise to indicate members' sponsorship or affiliation with any product or service without the prior express written consent of Developing Responsible Economically Advanced Model-Citizens, Inc. All other images presented not owned by Developing Responsible Economically Advanced Model-Citizens, Inc. are the property of the author, respective company, or photographer. The rights to the images and likeness represented are under explicit ownership of the person(s) aforementioned.