Broke: Why Professional Athletes Need Financial Education

/In a popular Kanye West song from his 2007 album, Graduation, West prophetically asserts at the beginning of one of his songs “wait ‘til I get my money right”! The song which went on to become a pop culture anthem during that year also highlights the mindset of many when it comes to finances; if we just had a few more dollars all of our financial problems would be solved. However the financial woes of many athletes tell a different tale. It’s generally accepted that if you don’t know how to manage $1 you won’t know how to manage $1 million.

In a recent Sports Illustrated article that sparked widespread conversation on blogs and Twitter it stated, "by the time they have been retired for two years, 78 percent of former NFL players have gone bankrupt or are under financial stress; within five years of retirement, an estimated 60 percent of former NBA players are broke." For many, the stats were alarming and unfathomable. How could these guys blow millions of dollars in such a short amount of time?!

“Broke”

On October 2nd, ESPN debuted its new season of 30 for 30 with a documentary called Broke, directed by Billy Corben. The 1.5 hour segment provided insight to the dire financial situations of many professional athletes, but more importantly it highlighted how many of them ended up in such despairing situations.

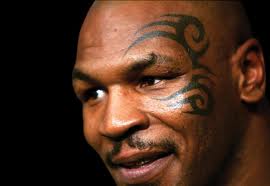

The program touched on the financial stresses of high paid, well regarded athletes such as Mike Tyson, boxing (has blown over $400mm in career earnings), Antoine Walker, NBA, (has blown over $100mm in career earnings), and Bernie Kosar, NFL, (has blown over $19mm in career earnings) all of whom had to file for bankruptcy. But there are scores of other athletes that have lost similar amounts. It would have taken days to sufficiently highlight all of these accounts, unfortunately.

So Where Does the Money Go?

For its part, the documentary does a good job of identifying how athletes lose their fortunes. For many athletes, especially those from inner city neighborhoods or from meager beginnings, the rise to financial prominence is an overnight occurrence with little preparation. They can literally go from having nothing to having it all in a matter of minutes as their names are called on draft day. In comparison to the wealthy or those with inherited fortunes, these young men have no established history of financial management, they generally don’t have the necessary networks of experienced advisors, and generally they are not raised in family situations where healthy relationships with money are maintained. So what do they do? They go out and buy fancy cars, jewelry, luxury homes, and make other ill advised purchases. They invest in things that seem promising but do little research regarding the validity of the investments. They get swindled by agents, crooked financial advisors, and unsuspected family and friends. When all is said and done many end up nose deep in debt with nothing to show from their glory days as professional athletes.

The latter parts of the program discussed the ways that professional leagues were attempting to help younger athletes manage their financial futures. As I tweeted aggressively during every commercial break, I couldn’t help but think that more of the program should have been focused on the need for financial literacy education among professional athletes more so than highlighting their downfalls, which is already explored at length. How can we reverse this trend? Of course, I have a few suggestions.

1. For starters, younger athletes should be provided financial literacy classes on the AAU level. Since athletes are ranked as early as 5th grade, it’s also a good time to teach them about money.

2. Rookie athletes should be required to invest 10% of their salaries in 401k or any type of retirement account upon signing their first contracts. The percentage should increase by 0.5% for each subsequent year.

3. Agents should not be allowed to manage the financial affairs of athletes.

4. All financial advisors utilized by athletes should be vetted by an independent third party before engaging with athletes.

5. All athletes should be required to participate in a mandatory amount of financial literacy and education classes prior to stepping foot on the court or field.

Click here for the website to the documentary. If you missed it, Broke, directed by Billy Corben will be airing again on Wednesday, October 24th at 10:30 pm on ESPN2.

And to all aspiring or professional athletes who read this blog, don’t worry, D.R.E.A.M. is currently developing a financial education program just for you! Stay tuned.

About the Author: Femi Faoye is the Co-Founder and Chief Executive Officer of D.R.E.A.M. He’s a staunch and passionate financial literacy education advocate.

Disclaimer:

Notwithstanding any language to the contrary, the views expressed in this post reflect those of the author and are solely theirs and do not reflect the views of Developing Responsible Economically Advanced Model-Citizens, Incorporated or any affiliates. Opinions are based upon information the author deems reliable but Developing Responsible Economically Advanced Model-Citizens, Incorporated does not warrant its completeness or accuracy and should not be relied upon as such. Neither the author nor Developing Responsible Economically Advanced Model-Citizens, Incorporated guarantees any specific outcome or profit from recommendations presented and you should be aware that losses may occur following any strategy or investment discussed. This material does not take into account your particular investment objectives, financial situation or needs. Before acting on information in this post you should consider whether it is suitable for your particular circumstances and strongly consider seeking advice from your own financial or investment adviser.

The contents of this post cannot be redistributed without the explicit written consent of the author and Developing Responsible Economically Advanced Model-Citizens, Inc. All images in this post owned by Developing Responsible Economically Advanced Model-Citizens, Inc. may not be used in any advertising, publicity, or otherwise to indicate members' sponsorship or affiliation with any product or service without the prior express written consent of Developing Responsible Economically Advanced Model-Citizens, Inc. All other images presented not owned by Developing Responsible Economically Advanced Model-Citizens, Inc. are the property of the author, respective company, or photographer. The rights to the images and likeness represented are under explicit ownership of the person(s) aforementioned.