Welcome to 2016 - How to Defeat Debt in 10 Simple Steps!

/Happy New Year! Feliz Año Nuevo! Bonne Année! On behalf of the entire D.R.E.A.M. Team I would like extend a wish of health, wealth and prosperity to you for 2016.

2015 was an exciting year of change for D.R.E.A.M.! We expanded our national presence, established new partnerships and increasingly touched the lives of urban youth. I look forward to what 2016 has in store for us. I know none of it would be possible without your munificence. Thank you!

--

Every January, I look forward to writing my annual guide of tips and financial resolutions to help set my readers down the right path in the nascent stages of each new year. In previous years, I have focused on saving, budgeting, and financial fitness. This year, I have decided to take on one of the biggest financial challenges facing young adults today, debt. With that in mind, the motif for 2016 is: How to Defeat Debt in 10 Simple Steps.

Young adults increasingly find themselves burdened with debt due to the inflated cost of higher education. The Class of 2015 was the most indebted class ever owing an average amount of approximately $35,000 as reported by the Wall Street Journal (a record previously held by the Class of 2014). It is estimated that Americans owe more than $1.2 trillion in student loan debt, a staggering figure that surpassed total credit card debt in 2012. To make matters even worse, Americans are also increasing their credit card debt. According to a CardHub study, there was an increase of $57.1 billion in new credit card debt in 2014. Creditcards.com provides a breakdown of some credit card debt statistics:

- $1,674 per account, U.S. adults with a credit report and Social Security number.

- $5,540 per U.S. adult with credit card.

- $9,600, per household with credit card debt.

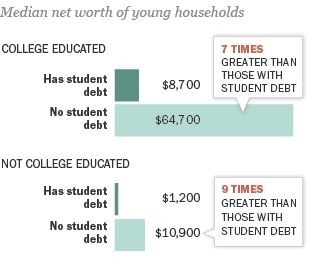

Although some debt is considered “good debt” (mortgages, student loans, and auto debt), debt can delay and outright cripple one’s ability to accumulate wealth and enjoy a life of financial freedom. A recent study by the Pew Research Center examined the effects of debt on wealth accumulation for young adults. A study finds that households headed by college educated adults (under 40) without any student loan debt have seven times the average net worth of similar households with student loan debt. Further, using a conventional debt-to-income ratio Pew reports that the median amount of debt for college-educated households with student loans is equal to about two year's worth of household income (205%) vs. one year's worth of household income (108%) for college educated households without student loan debt.

Pew Research Center

However, eliminating debt is easier said than done. For many, debt can take a toll on one’s emotional well-being. Unfettering from the shackles of debt requires understanding your debt, developing a clear plan, and abiding by strict budgeting. If your new year’s resolution is to eliminate the debt cloud hanging over your head, here are some tips to help you usher in a new, sunny, debt-free day.

1. Understand your debt - the cornerstone of defeating debt is fully understanding your debt situation. Determine how much debt you can afford to pay off each month. Bankrate.com has an excellent debt pay down calculator tool that I recommend.

2. Halt your credit card spending – this may seem intuitive, but you cannot climb out of debt if you are continuously accumulating it. Take all of your credit cards out of your wallet and leave them at home, in a safe place. (I personally like the freezer) If you don’t have the cash for something, do not purchase it!

3. Pay more than the minimum monthly payment – to decrease the amount of time you are in debt, pay more than the minimum. (I recommend a rule of 10%) Also ensure that you are paying off the principal and interest and not simply the interest.

4. Make bi-monthly payments – even though your debt statements may be monthly, you can still make payments throughout the cycle. I encourage people to make bi-monthly debt payments to decrease the overall amount of time spent in debt. This will also help raise your credit score. It’s a nice two-for-one deal.

5. Maintain a low balance on your existing consumer credit lines - don’t use more than 30% of your credit line – this will help to maintain or increase your credit score and ensure you have credit at times of emergency. If you are currently above the 30% threshold, your goal for 2016 is to get below this amount. Remember, the lower the better!

6. Pay off your smallest debt first – this is the snowball approach. Pay off your debts starting with the accounts with the lowest balances. The process of seeing debt eliminated should provide momentum to tackle larger debts.

7. Pay off a lump sum – are you expecting a bonus from your employer this year? Are you slated to receive a tax refund check from the IRS? Use these one-time monies to make a lump sum payment on your debt. In some fortunate cases, this may be enough to wipe out your debt completely. If not, it should at least provide considerable progress on your mission of becoming debt free.

8. Debt Consolidation –

- Personal Loan – if you are saddled with high interest debt such as credit cards, retailer specific credit lines, or medical bills, a personal loan can allow you to consolidate your debt into one monthly payment with a lower interest rate. Keep in mind, a credit score of 600 or higher is typically required for these loans. My recommendation is Earnest.

- Consolidate your Federal student loans – a Direct Consolidation Loan allows you to combine several Federal education loans into one loan. This provides a low, single monthly payment and can lower your interest rate. You can apply for a Direct Consolidation Loan here.

9. Move your credit card debt to a balance transfer credit card – many credit card providers are still offering 0% balance transfer APR promotions. That’s great news for you. This could get you up to 21 months, interest free to pay off your debt. I recommend the Chase Slate card, which features a 0% balance transfer APR and a $0 introductory balance transfer fee for transfers made during the first 60 days.

10. Seek alternative repayment options for student loans – these offers are generally only for Federal loans. However, they have some great features.

- Income-driven repayment plans: these borrower beneficial plans are designed to make student loan debt more manageable by reducing your monthly payment amount to a fixed, manageable percentage of your discretionary income. Click here for more details and to see which plan you are eligible for.

- Extended repayment: the life span of your loan term can be extended over a 25-year period.

- Graduated repayment: your monthly payment increases steadily over a 10 year span.

Following the aforementioned tips will assist you in making serious headway in defeating your debt. However, these steps must be a nexus with disciplined spending and budgeting to ensure you don’t quickly revert back into debt once you have accomplished your goal.

I hope these steps will help you take control of your debt in 2016. Here’s to a prosperous and debt-free year!

About the Author: Femi Faoye is the Co-Founder and Chief Executive Officer of D.R.E.A.M. He’s a staunch and passionate financial literacy education advocate. You can follow his insights on twitter @Femi_Faoye.

Disclaimer:

Notwithstanding any language to the contrary, the views expressed in this post reflect those of the author and are solely theirs and do not reflect the views of Developing Responsible Economically Advanced Model-Citizens, Incorporated or any affiliates. Opinions are based upon information the author deems reliable but Developing Responsible Economically Advanced Model-Citizens, Incorporated does not warrant its completeness or accuracy and should not be relied upon as such. Neither the author nor Developing Responsible Economically Advanced Model-Citizens, Incorporated guarantees any specific outcome or profit from recommendations presented and you should be aware that losses may occur following any strategy or investment discussed. This material does not take into account your particular investment objectives, financial situation or needs. Before acting on information in this post you should consider whether it is suitable for your particular circumstances and strongly consider seeking advice from your own financial or investment adviser.

The contents of this post cannot be redistributed without the explicit written consent of the author and Developing Responsible Economically Advanced Model-Citizens, Inc. All images in this post owned by Developing Responsible Economically Advanced Model-Citizens, Inc. may not be used in any advertising, publicity, or otherwise to indicate members' sponsorship or affiliation with any product or service without the prior express written consent of Developing Responsible Economically Advanced Model-Citizens, Inc. All other images presented not owned by Developing Responsible Economically Advanced Model-Citizens, Inc. are the property of the author, respective company, or photographer. The rights to the images and likeness represented are under explicit ownership of the person(s) aforementioned.